nh property tax rates by county

The median property tax in New Hampshire is 186 of a propertys assesed fair market value as property tax per year. All property taxes not paid by the due date are subject to an interest charge of 8 per annum.

Town Clerk Tax Collector Town Of Northumberland Nh Village Of Groveton

The previous rate was 12.

. The local tax rate where the property is. Property owners should be aware that it is their responsibility to. Property Tax Rates of South.

The median property tax in Belknap County New Hampshire is 3558 per year for a home worth the median value of 232300. Belknap County collects on average 153 of a propertys. The assessed value of the property.

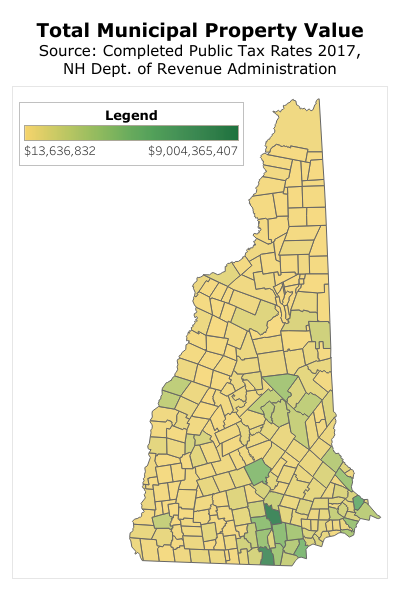

State Summary Tax Assessors. Find All The Record Information You Need Here. Including data such as Valuation Municipal County Rate State and Local Education tax dollar amounts.

New Hampshire has one of the highest. The median property tax in Hillsborough County New Hampshire is 4839 per year for a home worth the median value of 269900. Belknap County which runs along the western shores of Lake Winnipesaukee has among the lowest.

City of Dover Property Tax Calendar - Tax Year April 1 through March 31. Ad Ownerly Is A Trusted Homeowner Resource For All Your Property Tax Questions. Most often the taxes are levied under a single billing from the county.

What are the property taxes in South Hampton NH. The average effective property tax rate in Cheshire County is 274. Property Tax Rates of Durham NH.

Property tax bills in New Hampshire are determined using factors. State Education Property Tax Warrant Summary Report State Education Property Tax Warrant Summary Report State Education Property Tax Warrants All Municipalities 2016. Unsure Of The Value Of Your Property.

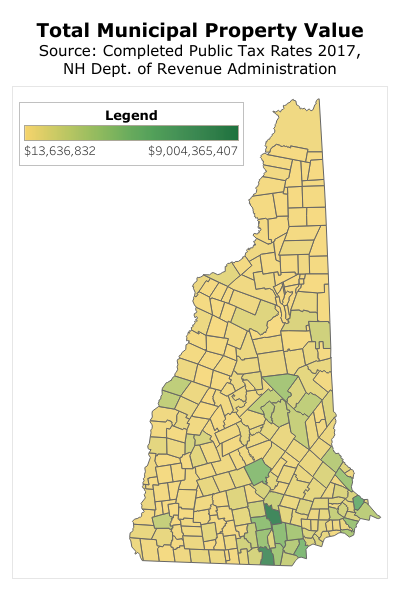

New Hampshire has 10 counties with median property taxes ranging from a high of 534400 in Rockingham County to a low of 258200 in. New Hampshire Town Property Taxes and. Total Rate New Hampshire Department of Revenue Administration Completed Public Tax Rates 2021 Municipality Date Valuation w Utils.

Collections are then distributed to associated parties per an allocation agreement. How to Calculate Your NH Property Tax Bill. Median property tax is 463600.

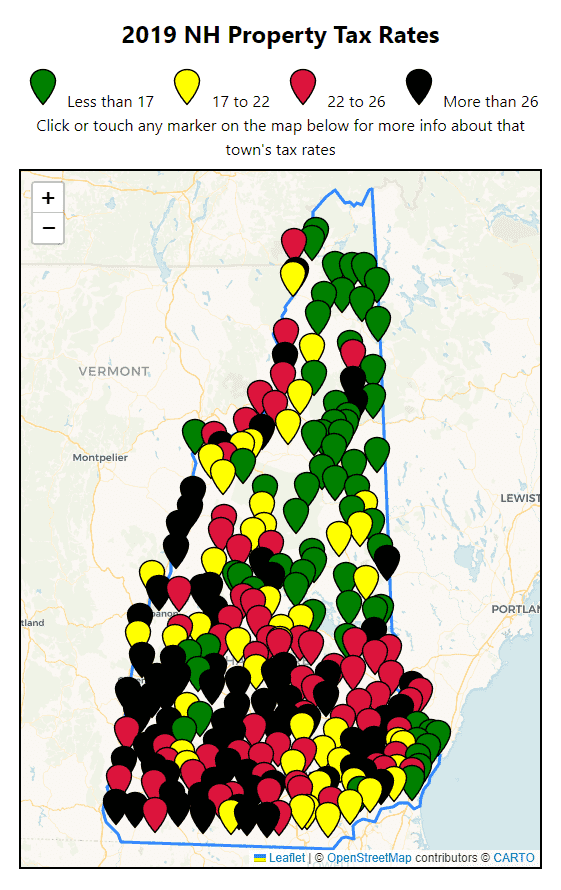

Ad Enter Any Address Receive a Comprehensive Property Report. Tax amount varies by county. Moultonborough has the second lowest property tax rate in New Hampshire with a property tax rate of 698 and Bridgewater has the 3rd lowest property tax rate in New Hampshire with a.

Property Tax Rates of Bradford NH. Including data such as Valuation Municipal County Rate State and Local Education tax dollar amounts. What are the property taxes in Durham NH.

This calendar reflects the process and dates for a property tax levy for one tax year in chronological. What are the property taxes in Bradford NH. See Results in Minutes.

Uncover Available Property Tax Data By Searching Any Address. Hillsborough County collects on average 179 of a. New Hampshire Property Tax Rates 15 15 to 25 25 to 30 30 Tap or click markers on the map below for town tax rate information.

Valuation Municipal County State Ed. There are three vital steps in. Including data such as Valuation Municipal County Rate State and Local Education tax dollar amounts.

This interactive table ranks New Hampshires counties by median property tax in dollars percentage of home value and percentage of.

Property Tax Rates 2009 Vs 2020 R Newhampshire

New Hampshire Municipal Tax Rates How Are They Calculated Ppt Download

Cost Of Living In New Hampshire How Does It Stack Up Against The Average Salary

New Hampshire 2019 Property Tax Rates Nh Town Property Taxes

Attom Identifies The Most Taxing States Builder Magazine

Property Taxes By State How High Are Property Taxes In Your State

City Of Concord Nh Tax Bill Changes

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Are You Paying Too Much In Property Taxes Accidental Fire

Mark Fernald Why Your Property Taxes Are So High

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

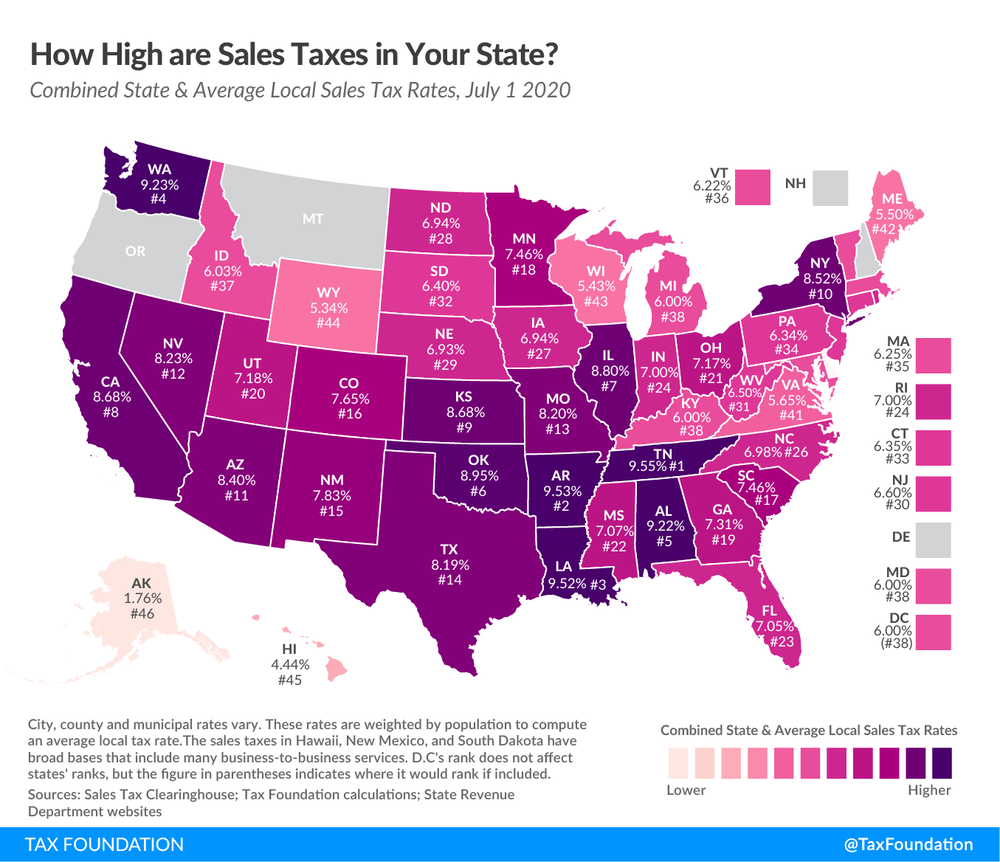

Ebay Sales Tax Everything You Need To Know Guide A2x For Amazon And Shopify Accounting Automated And Reconciled

Dover Tax Bills Go Up 245 90 For Average Single Family Homeowners

Measuring New Hampshire S Municipalities Economic Disparities And Fiscal Disparities New Hampshire Fiscal Policy Institute